It’s virtue signalling for philanthropy executives to oppose a system for which they owe their very existence.

In recent conversations, I have increasingly heard voices from colleagues who squarely reject the market economy and despise its underlying societal goal – to generate the wealth and prosperity upon which our livelihoods depend. Sometimes, it seems, that the more aggressive the company behind a philanthropic foundation, the more progressive, utopian, and even anti-capitalist the foundation and its staff are.

Why is that? What is so special about foundations that their executive staff rebel against the market economy in their views – and often their programming – while they undoubtedly owe their own economic existence to it?

Social change and a better world – that’s exactly why we all chose to work in the foundation sector, didn’t we? I am no exception here. After starting my career, it took me years to understand why ‘my’ first CEO toned down certain decisions for institutional or political reasons or vetoed projects that were excellent in my eyes. Nobody told me why that was, neither during recruiting nor during onboarding. And I argue that this is what often leads to the wrong people joining foundation teams and, eventually, burning out.

In many foundations, indeed there seems to be a dynamic of ‘progressive’ staff proposing projects that alarm the more ‘conservative’ board. Perception among the staff often is that the board unduly slows them and their programs down. Floating in between is the CEO, whose intimidating task is to find a middle ground between team and board.

This remains a very poorly managed problem in many places. Sometimes even Foundation CEOs themselves fall prey to this problem. And I fear this might be because very often they have to speak different languages inside and outside of their foundation, concealing their real opinions or philosophies (and those of their teams, as it were) when talking to their boards. Such a lingering philosophical dissent between management and board paralyzes a foundation. It can surely be managed for some time, but ultimately, it leads to a serious conflict that the CEO can only lose, as we have seen more than once during the past years.

Also, it needs to be said again, too much time is spent in so many foundations to polish PowerPoints, building Potemkin’s Villages, rather than on preparing and leading open, strategic discussions with the board. Again, this creates a cognitive dissonance between board and team – and CEOs in between – that will in the long-term lead to institutional failure.

Can – and should – philanthropy oppose a system to which foundations owe their very existence? If we are honest with ourselves, the answer must be ‘no.’ And if that’s our aim, we should probably not work for a foundation.

Obviously, I am aware, the best solution to the challenges listed above would be a totally different kind of market economy. An economy that does not need foundations. One in which entrepreneurs, corporates, and executives themselves become accountable, social changemakers – rather than letting ‘their’ Foundations do it for them. And there are bold initiatives that try to achieve this: Andre Hoffmann, one of the Swiss Roche heirs, has recently spent down and dissolved ‘his’ MAVA Foundation to follow exactly this idea. His worldview replaces shareholder value and return on investment with social impact as the key impact measure. Yet, as visionary as this is, it must not be forgotten that Hoffman, too, was only able to develop this philosophy on the basis of assets acquired in the market economy. So at least for today’s existing foundations, his model cannot be the answer to this conundrum.

I therefore strongly believe that potential solutions are to be sought and found within foundations, but we need to address these tensions more openly and productively.

In my experience co-leading a major Swiss foundation, openness for innovation in programming is key. It is entirely possible for us to take up issues and positions that are critical of the market. We can do this, exactly because of our special position between the market and civil society. The Jacobs Foundation’s program TRECC is a good example of this. Using our standing as a chocolate manufacturer, we were able to build a unique partnership between the Ivory Coast Government, leading cocoa companies, philanthropic organizations, NGOs, researchers, and social ventures to fight child labour – a most critical topic for the industry – through quality education. Only a foundation could broker that kind of cross sectoral action.

Openness and transparency vis-à-vis the board is also indispensable: No topic should be off-limits in regular exchanges CEOs have with their chairperson. Program leads should participate in board meetings and receive direct feedback from trustees. Building mutual understanding between staff and board is key.

Openness and honesty in recruiting is critical too. Talking about the market economy, institutional limitations, and political constraints might scare away some very talented candidates. But it will in the end create a more dedicated, motivated Foundation workforce. Not all of our staff were at ease with our strategic focus on market-based funding instruments – some of them we took on a learning and development journey. Others left and are now working in the NGO sector, which operates perhaps at one remove from the market economy – where they do seem to feel more at home.

These principles don’t make our lives any easier in the short term. But being open and upfront about who we are and what we represent will not only help resolve conflict but ultimately is indispensable to building a sustainable foundation sector.

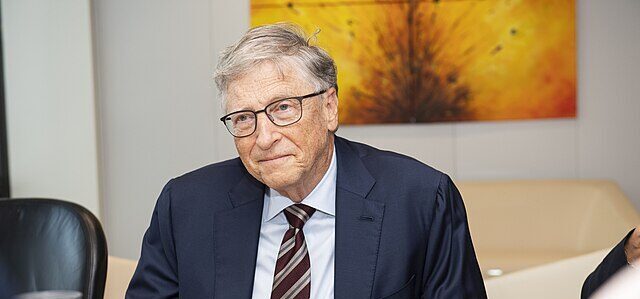

Simon Sommer is co-CEO at the Jacobs Foundation.

Credit:Source link