Jump to each section:

NOTABLE IMPACT FINANCE DEALS

Social enterprise Vanilla Ink CIC, which aims to improve people’s wellbeing through jewellery-making classes, has received investment from Social Investment Scotland

- Brazil: AXA IM Alts, the alternative investment arm of asset manager AXA IM, has committed US$49m to projects run by reforestation startup Mombak in the Amazon. The investor has also taken an equity stake in the startup.

- Scotland: Social Investment Scotland has agreed a £45,000 loan to social enterprise Vanilla Ink CIC, an independent jewellery school in Glasgow’s East End that improves lives by offering courses to people who wouldn’t otherwise be able to afford them.

- Madagascar: The European Investment Bank has agreed a €20m loan to Sahanala, a Malagazy social enterprise that works to increase sustainable agriculture and fishing, improve food security and support local communities.

- India: Upaya Social Ventures has invested US$50,000 in Agrify Fresh, a Mumbai-based agri-tech venture that connects farmers with retailers to guarantee high-quality fresh produce while improving farmers’ livelihoods.

- US: Grapevine, a philanthropic giving platform where individuals can team up to donate to a common cause, has raised US$1.67m in equity financing and an additional US$180,000 in grants in a seed round led by venture capital firm PJC.

- Rwanda: Impact investing firm Goodwell Investments has invested in SOUK Farms to enable the company to scale its sustainable agriculture operations while supporting farmers’ livelihoods.

- Netherlands: Circular startup Valyuu, a platform where users buy and sell pre-owned electronics aiming to tackle e-waste, has raised a €2.4m seed round from investors including impact VC firm Rubio Impact Ventures, Slingshot Ventures, Golden Egg Check and several others.

- US: Impact investing firm ImpactAssets has partnered with Connecticut Green Bank and Inclusive Prosperity Capital to provide a US$12m loan to PosiGen, a company that provides people on low and moderate incomes with affordable equipment to generate solar power and that helps them make their homes more energy-efficient.

IMPACT FUNDS TO WATCH

Sustainable aquaculture company, Tilabras, is among Ocean 14 Capital Fund’s investees

- Global: Blue economy impact fund Ocean 14 Capital Fund has secured a €20m investment from corporate insurance firm Convex Group, bringing the total raised by the fund to €160m. Ocean 14 has also announced a recent €10m investment in Ava Ocean, a Norwegian technology and seafood company which has developed a sustainable alternative to dredging.

- UK: A new social impact investment fund to tackle inequality in Greater Cambridge has secured £200,000 seed funding from Cambridge City Council. The fund, which has a £10m target size, will invest in charities and social enterprises addressing education, social mobility, health and life expectancy and homelessness.

- Global: Heading for Change has secured a US$750,000 grant from Hong Kong-based family office RS Group Asia, according to the fund’s founder Suzanne Biegel, who welcomed the deal as a “significant milestone”.

- Read more about Heading for Change: Suzanne Biegel: ‘It took me having a fatal illness to come back to my original self’

- Ghana: British International Investment, the UK’s development finance institution, has launched Growth Investment Partners Ghana, a new investment platform that will provide long-term flexible capital, primarily in local currency, to small and medium-sized enterprises in the country. BII has committed up to US$50m to anchor the investment platform.

- US: Impact investment firm RuralWorks has launched its inaugural fund, RuralWorks Impact Partners 1, which will invest in growth-stage businesses operating in rural communities and working on regenerative agriculture, waste upcycling and the circular economy, among others.

GRANTS FOR MARKET-BASED SOLUTIONS

- Sub-Saharan Africa: The Health Finance Coalition – a group of donors, investors and partners working to advance public health in Africa – has received a CA$500,000 grant to invest in locally-led healthcare solutions in sub-Saharan Africa. The funding comes from Canadian government-backed impact investor Grand Challenges Canada.

- Canada: The government of Canada has announced a non-repayable investment of CA$82,000 for the Newfoundland-Labrador Federation of Co-operatives, which will launch an incubator to support the growth and development of new local co-operatives.

INITIATIVES AND ADVOCACY

- Japan: The Financial Services Agency’s working group on impact investment has published its report, which includes draft guidelines to summarise the basic ideas and processes of impact investment. The regulator is inviting feedback from the public until 10 October.

RESEARCH AND PUBLICATIONS ON OUR RADAR

- UK: Data firm Beauhurst has published an analysis of the UK’s most active impact funds. Top of their list of 80+ funds is Ascension, having announced 220 equity deals with high-growth companies since 2012, followed by Triple Point Ventures (62 deals) and Fair by Design (49 deals).

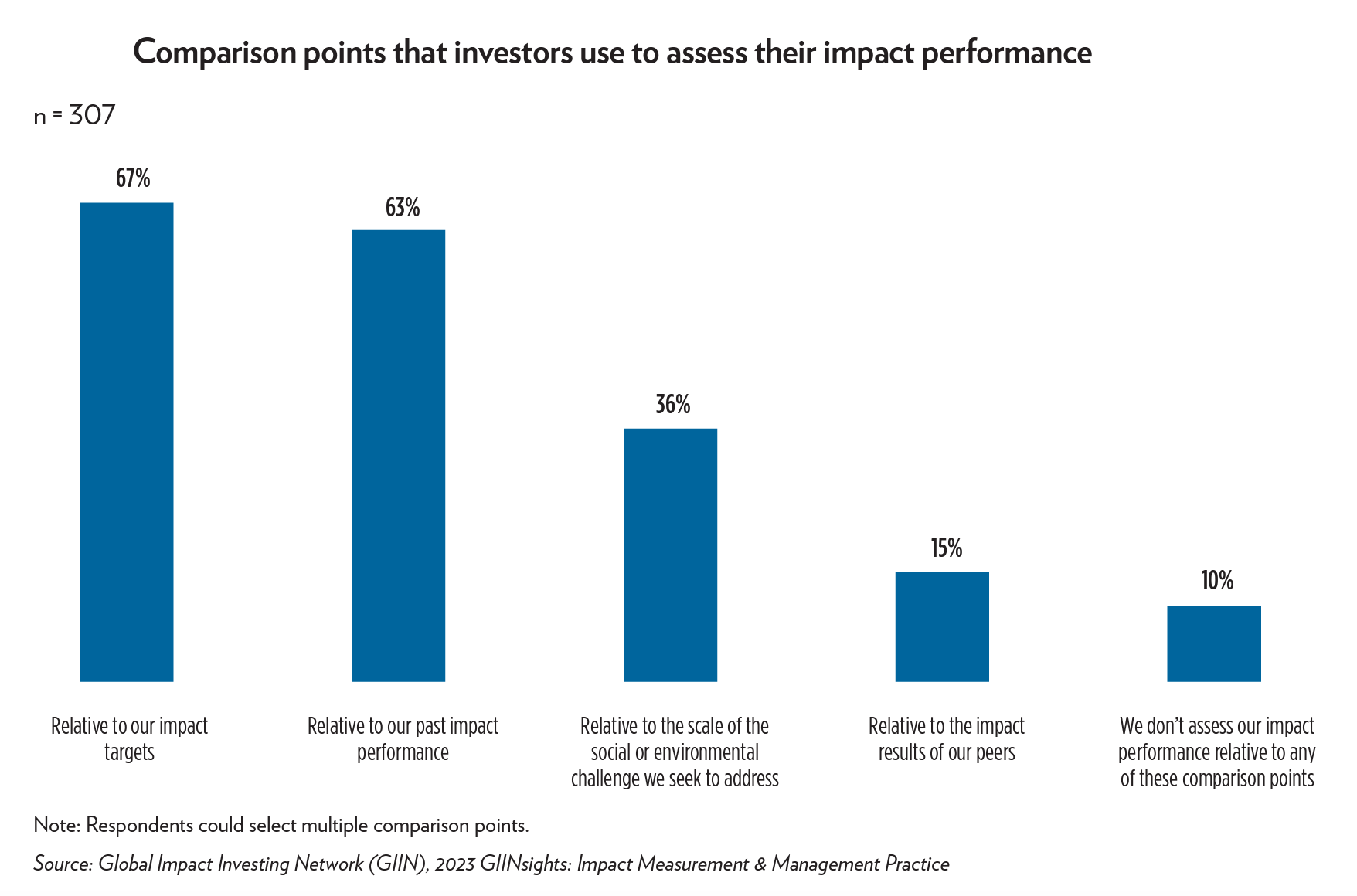

- Global: Three-quarters of impact investors believe the inability to compare impact results with peers is a significant or moderate challenge in the industry – and just 15% say they are currently using such comparisons, according to a recent GIIN report. Read more on Pioneers Post.

- Global: The GIIN’s most recent report, Emerging Trends in Impact Investing, finds that investors plan to increase capital allocation to emerging markets and the energy sector, despite a challenging macroeconomic environment.

INVESTOR IMPACT REPORTS

ABC Fund investee Africa Négoce Industries, which processes cashews from smallholder farmers for export markets

- Global: The Agri-Business Capital Fund has published its third impact report, which reveals that the fund has invested in 28 organisations across Africa and Latin America since its inception in 2019. ABC Fund investees support nearly 600,000 small-scale farmers, 67% of which are women, according to the report.

- UK: Esmee Fairbairn Foundation has published its 2022 annual report; it shows the organisation provided £36.2m in grants last year (down from £51.5m the year before); it committed £2.7m in social investment to social ventures and made a £1m impact investment in the Green Generation Fund.

- UK: The Women in Safe Homes fund, a social property fund that provides safe housing to women fleeing domestic abuse, has published its 2022/2023 impact report. It shows that 120 tenants were housed by the fund as of June 2023, including 77 women and 43 children, with 83% of women reporting improved mental health since living in their home.

- UK: Ethical lender Unity Trust Bank reported record-level lending of £900m in its half-year results, with 37% of lending going to areas of high deprivation; the bank’s profit before tax for the first half of the year has trebled since last year, to £28.7m.

Top image: a bird flying over a South American rainforest (credit: vladimircech via Freepik). Other images supplied.

Thanks for reading Pioneers Post. As an entrepreneur or investor yourself, you’ll know that producing quality work doesn’t come free. We rely on our subscribers to sustain our journalism – so if you think it’s worth having an independent, specialist media platform that covers social enterprise stories, please consider subscribing. You’ll also be buying social: Pioneers Post is a social enterprise itself, reinvesting all our profits into helping you do good business, better.

Credit:Source link